In July 2025, China’s top policymakers have officially confirmed that Hainan Free Trade Port (HFTP) will implement its long-anticipated "customs closure" (“封关运作”) on December 18, 2025. While the term “封关” (literally “port closure”) may suggest restrictions, the policy is designed to further liberalize trade by creating a closed-loop customs supervision regime that separates Hainan from the mainland’s general customs territory.

The reform marks a significant milestone in China’s phased plan to transform Hainan into a high-standard, globally competitive free trade port - a policy blueprint first introduced in 2018 and detailed in the 2020 Master Plan.

HFTP Policy Framework and Key Mechanisms

What's Haihan Free Trade Port

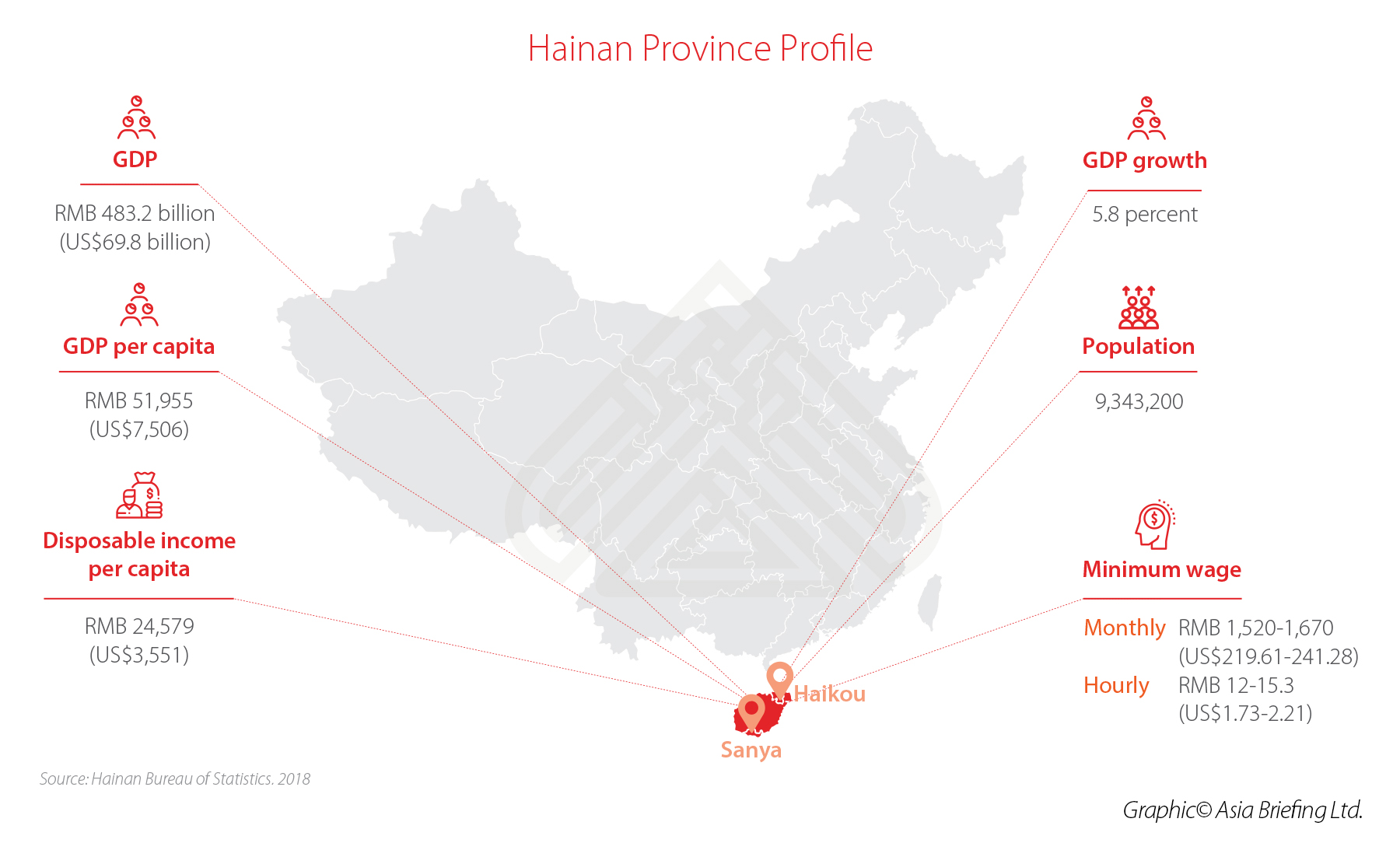

Hainan, China’s southernmost island province, was designated in 2018 to become the country’s largest free trade port and a testing ground for high-level institutional opening. Key milestones:

- 2018 – Central government announces plans to transform Hainan into a Free Trade Zone, then Free Trade Port.

- 2020 – Master Plan for HFTP released, introducing a phased roadmap to full customs independence.

- 2021–2024 – Pilot tax reforms, simplified import/export procedures, cross-border capital controls easing, and relaxed visa policies.

- 2025 – “封关运作” begins: Hainan separates its customs border from the rest of mainland China and launches a full closed-loop customs system.

The ultimate goal is to make Hainan a globally influential free trade port by 2050, with world-class legal, financial, and digital infrastructure that supports innovation, international investment, and green growth.

The upcoming system will establish a dual-line customs control:

Hannan's Duty-Free Economy

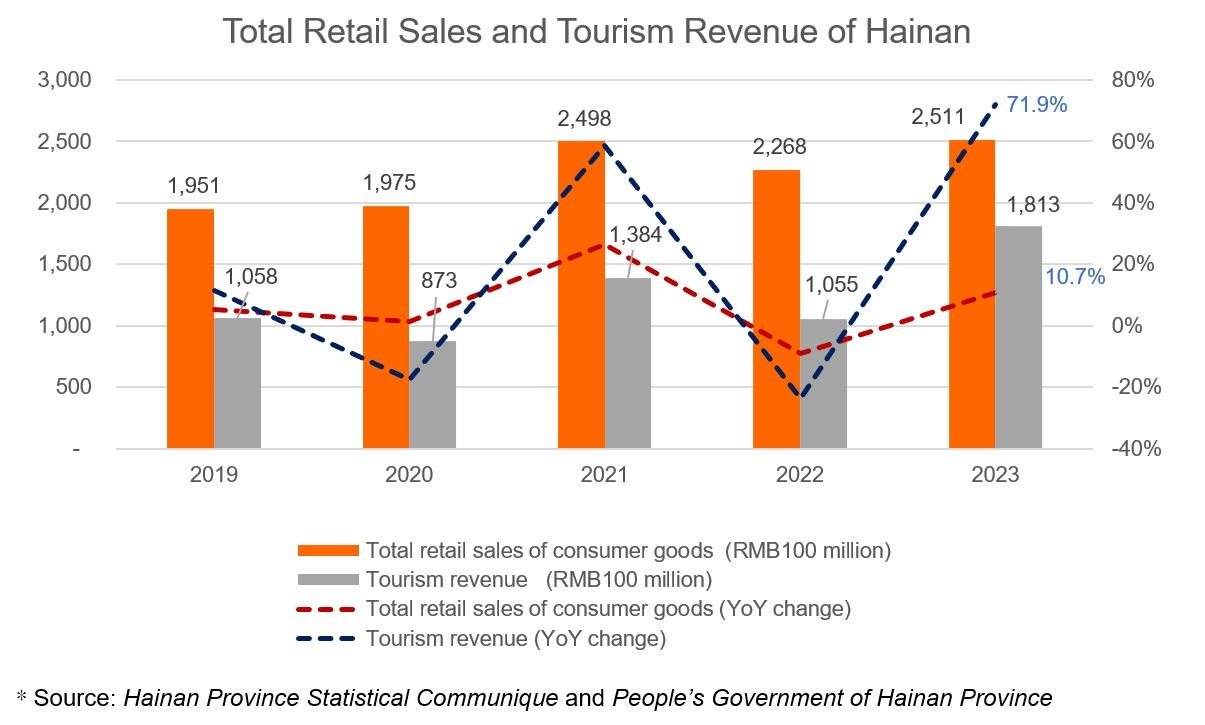

- 2024 duty-free sales totaled RMB 30.9 billion (USD 4.25 billion), down 29% year-on-year amid weak domestic demand and intensified overseas competition.

- Shopper volume fell by 16%, from 6.76 million in 2023 to 5.68 million in 2024.

- However, the 2024 Spring Festival holiday alone generated RMB 6.61 billion in duty-free sales, indicating seasonal spikes and resilient high-end consumption.

- The China Tourism Group Duty Free Corp. reported 2024 revenues of RMB 56.5 billion, maintaining its dominant market position despite a 19.6% annual decline.

Strategic Positioning: Hainan and Hong Kong

Comparative Roles: Hanhan vs Hong Kong:

| Factor | Hong Kong | Hainan FTP |

| Economic Focus | Financial services, global trade | Tourism, consumption, regional trade |

| Tax Structure | Low, stable tax regime | Zero tariffs, income tax incentives |

| Customs Status | International port | Independent customs territory (from Dec 2025) |

| Institutional Maturity | Institutional Maturity | Developing with targeted policies |

Recommendations for Global Brands and Marketers

1. Recalibrated Retail Strategy

2. Regional Distribution & Logistics

3. Brand Positioning Opportunities

4. Cross-Market Synergies

Looking Ahead

Stay Ahead with Us

As China’s policy landscape continues to evolve, we’re here to help global businesses navigate the complexities—and seize the opportunities. From in-depth insights on Hainan and Hong Kong to practical go-to-market strategies across Greater China, our team delivers timely analysis and actionable advice. Follow YIVA's Linkedin Page for regular updates, expert commentary, and exclusive briefings that help you stay one step ahead in the world’s most dynamic market.