The mid‑year 618 Shopping Festival has evolved far beyond a simple discount event. This year, it became a strategic showcase highlighting how Chinese e-commerce is redefining itself through smarter spending, advanced tech, high‑impact content, policy support, and global ambitions.

1. Record GMV, Yet Measured Consumer Behavior

- The total Gross Merchandise Value (GMV) soared to ¥855.6 billion (≈$119 billion), marking impressive growth.

- Interestingly, average daily spending declined slightly compared to last year—signaling that consumers are spending more thoughtfully, taking advantage of early deals and structured promotions rather than splashy one‑day splurges.

2. From Flash Sales to Emotional Connection

- Brands shifted focus from aggressive discounting toward building trust, loyalty, and long‑term value.

- Examples of this shift include JD.com’s 30‑day price protection and platforms simplifying promo mechanics to make shopping feel less like a puzzle and more like an experience.

- Storytelling, lifestyle positioning, and brand purpose are taking center stage over gimmicks.

3. AI as a Core Sales Engine

Huge investment in AI tools across e-commerce ecosystems:

- Automated review summarizers to help make purchasing decisions faster;

- AI-generated promo videos to streamline content production;

- AI agents and chatbots front-lining customer interaction.

- Merchants using these tools were able to tap into efficiency gains and stronger personalization at scale.

4. Content Meets Commerce

- Short videos, livestreams, and user-generated content were fully integrated with product exposure.

- Platforms like Douyin, Kuaishou, Taobao, and Tmall leaned heavily on content-style campaigns, featuring niche hosts and community storytelling—making discovery and engagement the new center of commerce.

5. Trade-In Programs & Government Support

- Massive trade-in initiatives led to exponential growth in categories like smartphones and home tech.

- Government subsidies, coupled with platform incentives, lowered upgrade barriers and fueled demand—especially for flagship and sustainable products.

6. Lifestyle & Beauty Go Big

- Spending extended beyond core essentials. Lifestyle categories, collectibles, pet care, entertainment, and beauty all saw strong double-digit growth.

- International beauty brands, aided by simplified pricing and AI tools, regained momentum and momentum with Chinese consumers.

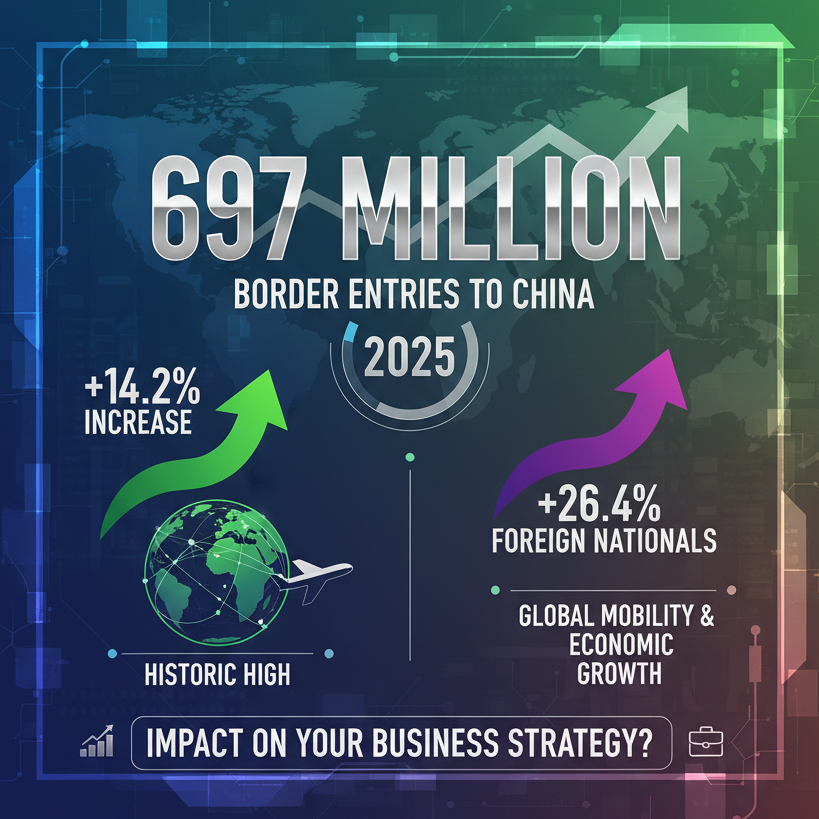

7. Brands Going Global

- Increasing numbers of Chinese electronics and consumer brands used 618 as a launchpad into overseas markets.

- Cross-border orders surged, as platforms offered international logistics support and removed cost barriers—opening the Chinese consumer mindset to global reach.

Why This Matters for Global Brands

- Consumers are now strategic: patterned purchase timing, higher expectations, and emotion-driven engagement.

- AI is business-critical: No longer experimental—this is where personalization, content creation, and customer service meet ROI.

- Commerce is storytelling-driven: Content and community are now inseparable from conversions.

- Festivals are global launchpads: What succeeds in China can echo in other markets.

Recommendations for Marketers

| Focus Area | Strategic Move |

| Value + Emotion | Use pricing assurance and alignment with consumer values rather than just deep discounts |

| Tech-enabled Scale | Deploy AI early—for review summarization, chat, content creation, personalization |

| Content-first Play | Build campaigns around authenticity and micro-influencer storytelling |

| Policy Advantage | Consider regional trade-in programs & subsidies when planning product positioning |

| Cross-border Leverage | Treat Chinese festivals as pilots for overseas rollout strategies |

The 2025 618 Festival wasn’t just the end of a sales event—it was a turning point. What emerged was a maturing ecosystem where efficiency, emotion, and global expansion matter more than aggressive markdowns. For international brands eyeing China—or just watching for inspiration—this is the moment to sharpen your strategy.

At YIVA Digital, we partner with your brand to:

- Build emotionally intelligent campaigns powered by AI and content

- Structure trade-in & subsidy-ready pricing

- Launch globally via China-testbed strategies

- Connect authentic storytelling to measurable growth

- Ready to break through the noise this Double 11? Let’s chat!

- Build emotionally intelligent campaigns powered by AI and content

- Structure trade-in & subsidy-ready pricing

- Launch globally via China-testbed strategies

- Connect authentic storytelling to measurable growth

Ready to break through the noise this Double 11? Let’s chat!