What are the investment opportunities in China after relaxing Covid restriction?

With China’s new Covid policy introduced on 7th Dec, 2022, the covid measurements, testing and quarantine policies have been further adjusted and optimized. 3-years of tight Covid-19 restrictions have been loosed. The economy will gradually recover, and it is expected to accelerate after the 2023 Spring Festival. In the process of policy loosening, the recovery of freight logistics and residents' increasing willingness to travel will support consumption in the future. Although the Covid impact on China's domestic market will not completely disappear until the 2023H1, we recommend watching out for these market opportunities in the mainstream market.

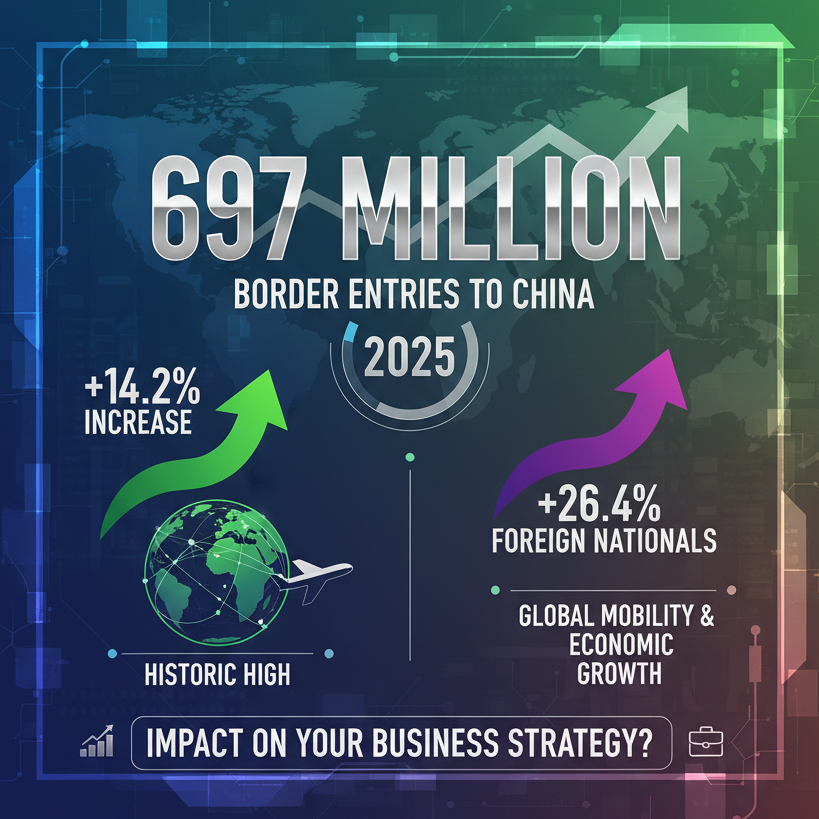

Travel industry: The recovery of the travel industry is supposed to be one of the main supports of the consumer industry in the future. Referring to the experience of other countries, leisure demand in the early stage of opening up promoted the recovery of passenger flow and prices. If the situation in 2023 is relatively optimistic, the order of recovery of domestic tourism performance is OTA, catering, hotels, and scenic spots.

In terms of airports, the implementation of early policies will promote the rapid rebound of flight volume. The long-suppressed demand for visiting relatives is expected to be released in the Spring Festival travel rush in 2023, and the aviation demand may return to about 80% in the same period of 2019.

Alcohol industry: Chinese white spirit industry is expected to improve, while beer's upgrade is gradually realized. Under the background of Covid-19 recovery, consumption restoration is expected to be open, and the local-traffic-based restaurants are expected to be restored first. Alcoholic beverages including liquor and beer will be driven to some extent. The sales volume of liquor is affected by the Spring Festival, while the prosperity of the beer industry is estimated to show a trend of first high and then low.

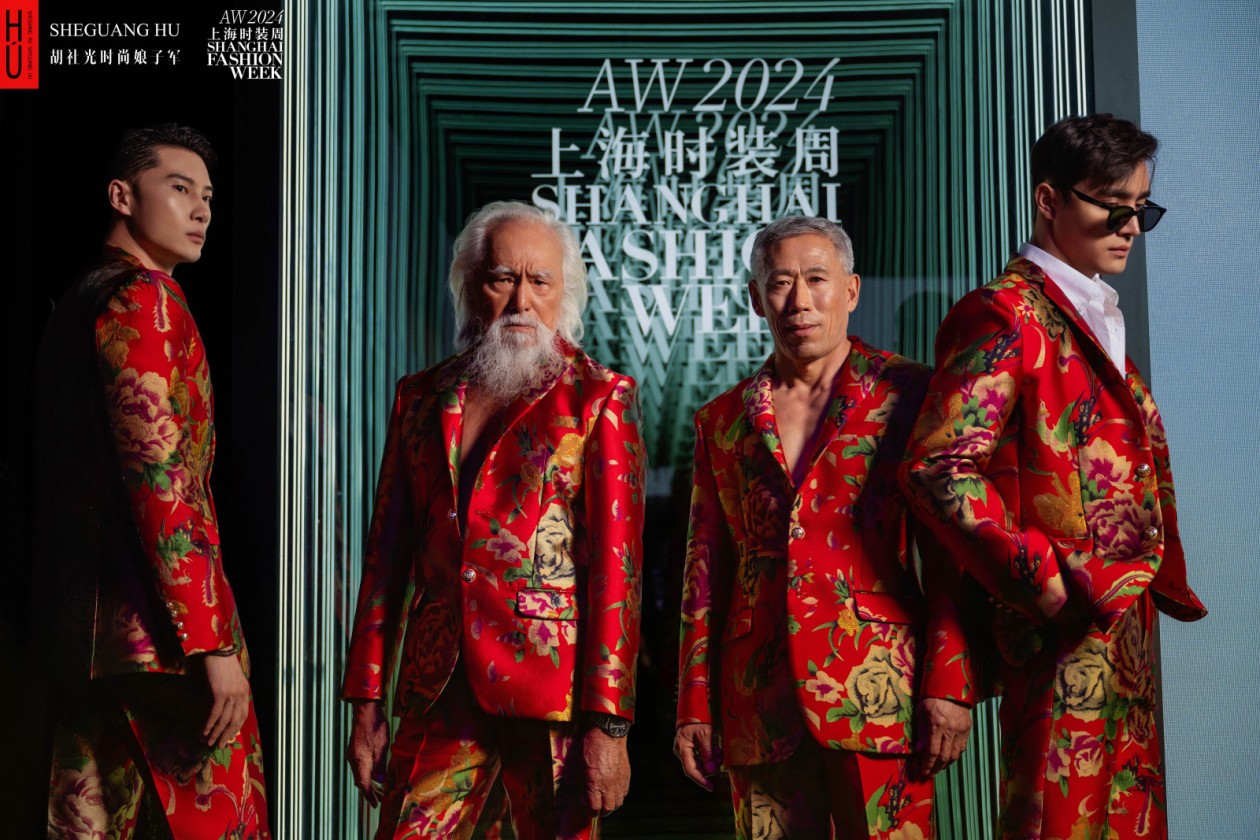

Retail industry: Impacted by policy, the return of value is just around the corner. Marginal relaxation of controls and consumption policies will stimulate the retail industry to keep its upward trend in the next one to one and a half years, and the long-term improvement in profitability brought about by cost reduction and efficiency increase during the year will likely continue.

There is a steady growth in the E-commerce industry, but each merchant will experience a different level of revenue growth and profitability. Aside from this, local life industries and small merchants, whose business activities and cash flow have been severely affected by Covid-19 throughout the year, will begin adjusting their strategies, for example, entering social media platforms like Tik Tok, constitute a differentiated competition in users' minds and product forms.

Sportswear: The rise of domestic production and the enhancement of subdivision. It is relatively clear that the Covid-19 control policies are to be optimized, and the sports industry is expected to see a recovery trend, with the rise of domestic brands and the easing of competitive pressure of overseas brands, market share is expected to continue to shift to top domestic brands. As an optional consumption, footwear sees higher elasticity and rebound strength.

Beauty and cosmetics: Growth rate slows down, with skincare consumption more rigid than make-up. Looking ahead to 2023, brands with excellent quality, product strength, marketing strength, channel strength, and other comprehensive capabilities will become leading brands after the recovery of Covid-19. R&D and raw materials will be the decisive factors in industry competition in the future.

Homeware: Shocks still remain the main theme of the homeware industry, but in terms of home appliances, white goods and major appliances are expected to recover their profits due to the decrease in raw material prices. Consumers' attention to kitchen appliances will be more on specialization, cost performance, and new categories. In the coming years, the sales of dishwashers and integrated stoves will recover significantly. In addition, massage appliances will be favorable in the future.

Machinery: With the further optimization of the domestic Covid-19 situation and the recovery of production, the demand for forklifts is expected to gradually recover from the fourth quarter of 2022 and enter the upward phase. In the field of robots, manufacturing companies have been encouraged to use people rather than robots through Covid-19's market education for domestic manufacturing enterprises.

YIVA Digital is a Chinese marketing agency to support western brands to enter the Chinese market. If you want to learn more about the China market, please subscribe to our newsletters or feel free to contact us.