Consumer behaviour has been shifting ever since Covid-19 happened and we can witness that . products or services that appeared to be following a transparent trajectory found it had been not the case thanks to unpredictable consumer behavior. The pandemic has pushed us to be more aware of the swiftness of consumer behaviours. The faster we are able to track the consumer trend, the more we are able to understand people’s changing feelings about everything from brand behavior to holiday spending.

However, there is a segment of consumers in lower-tier cities in China who continue spending money freely without any worry about cost or saving for the future. Other consumers, mostly in large cities like Beijing, Shanghai, and Guangzhou are responding to the dip in China’s economic process and therefore the increased cost of urban living by adjusting their spending attitudes.

In 2021, we have identified some of these key trends which might be useful for brands to thrive in the new norm of China. Brands need to pay more attention to create new consumer values as there are clear changes in consumers’ perception of health, safety and staying more at home. Besides that, Investment in product experience and innovation is very important to drive growth in the digital market. Companies have to be ready and to anticipate what’s coming.

On top of that, Young digital natives who reside predominantly in tier 2, 3 or 4 cities, where living costs are lower than staying in big cities are supposed to be the new target market for all the brands. In general, they are optimistic about their futures and have little hesitation towards spending their money.They spent more time on their mobile phones than their counterparts in tier 1 cities. Consumers in small cities tend to leave work and arrive home at 5 or 6 pm sharp and spend less time commuting from one place to the others. Having more of their leisure time allows them to dine in, follow the latest trends, and buy products that will enhance their lifestyle and social status. Young Free Spenders also believe that expensive products are generally better and they aren’t particularly concerned with saving for the future. Such habits afford them considerable spending power.

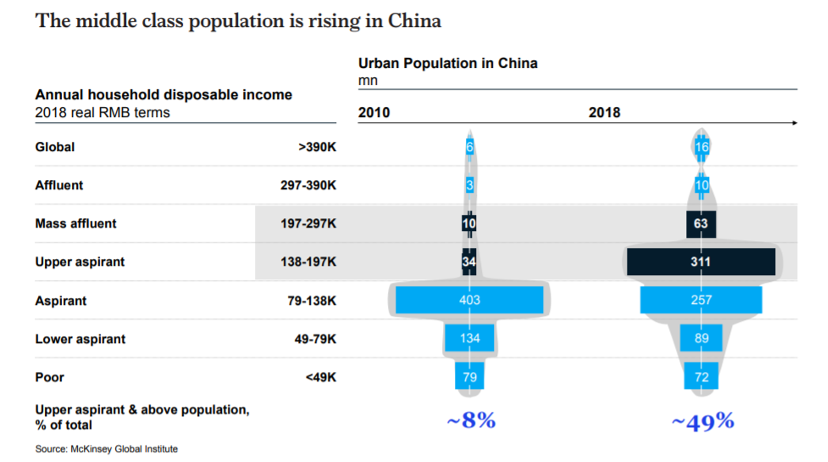

Although much of the eye on China’s new generation of affluent consumers have focused on urban areas like Beijing and Shanghai.The emergence of this group shines a spotlight on the importance of consumers in lower-tier cities, like Mianyang, Yancheng, and Zigong.In recent years, the numbers of middle and upper-middle-class consumers in tier 3 and 4 cities have risen at a rapid speed. The number of households with annual income of 140,000-300,000 yuan.

Consumers have increased significantly in lower-tier cities.The increased spending of Young Free Spenders in lower-tier cities has been fueled, in part, by e-commerce platforms.

Relatively affluent households now account for quite 34% of the population in tier 3 and 4 cities in tier 3 and 4 cities increased by 38% CAGR from 2010 to 2018,ngreater than the 23% growth seen in tier 1 and a couple of cities. These relatively affluent households (what we call ‘upper aspirant’ and ‘mass affluent’ classes) now account for quite 34% of the population in tier 3 and 4 cities, nearly the proportion found in high-tier cities five years ago.

With this important insight, we believe that the increased spending of the Young Free Spenders in lower-tier cities has been fueled, totally on the e-commerce platforms like Pinduoduo and 1688, which have helped expand the supply of branded products in these cities. Consumers can now purchase quite a thousand brands on these platforms, and they account for anywhere between 10% to 30% of a category’s sales on these sites.