China enters 2026 at one of the most consequential transition points in its modern economic history. With GDP reaching 140 trillion yuan, the country is no longer navigating a question of scale, but one of economic identity.

The conclusion of the 14th Five-Year Plan (2021-2025) and the launch of the 15th Five-Year Plan (2026-2030) marks a structural shift away from growth driven primarily by exports, infrastructure investment, and labor cost advantages. In its place emerges a development model centered on domestic consumption, technological sovereignty, social resilience, and global system participation.

President :contentReference[oaicite:0]{index=0}’s 2026 New Year Address, together with Vice Premier :contentReference[oaicite:1]{index=1}’s remarks at the :contentReference[oaicite:2]{index=2}, signal a clear message to global markets: China is prioritizing long-term structural reform while positioning itself as a stabilizing force in an increasingly fragmented global economy.

For global enterprises, investors, and digital strategists, China in 2026 is not a short-term rebound story. It is a systemic transformation story, where policy, technology, culture, and consumption are deeply interconnected.

1. Macro-Economic Foundation: Understanding the 140 Trillion Yuan Economy

China’s economic scale has reached a level where incremental growth alone reshapes global demand patterns. Over the past five years, China maintained an average annual growth rate of approximately 5.4%, contributing nearly 30% of global economic growth.

While these figures appear moderate by historical standards, their absolute impact is unprecedented. A one-percentage-point increase in China’s GDP today generates more output than several years of double-digit growth in earlier decades.

The year 2026, as the opening year of the 15th Five-Year Plan, plays a disproportionate role in shaping policy direction. Opening years establish fiscal priorities, regulatory tone, and capital allocation for the next development cycle.

Three macro shifts define this phase:

- Growth quality has overtaken growth speed as the primary policy objective

- Domestic demand is becoming the core engine of economic expansion

- “Common prosperity” is increasingly treated as economic infrastructure rather than political rhetoric

For global companies, this means China’s growth will be increasingly concentrated in urban clusters, specialized consumption segments, and service-driven value chains, rather than uniform nationwide expansion.

2. From World’s Factory to Global Consumption Giant

China’s consumption upgrade is not an attempt to replicate Western consumer models. Instead, the country is building a digitally native, platform-driven, and service-integrated consumption system.

Several structural forces underpin this transition:

- A mature middle-income population with increasingly differentiated preferences

- Near-universal adoption of mobile payments and digital identity systems

- Deep integration of social platforms, content ecosystems, and commerce infrastructure

Consumption growth in China is increasingly driven by premiumization, customization, emotional engagement, and community-based loyalty, rather than pure volume expansion.

Policy support reinforces this trend. Employment stabilization, social welfare enhancement, and targeted fiscal measures are explicitly designed to reduce household uncertainty and unlock consumption demand.

For international brands, China remains a massive opportunity, but success now depends on local relevance, cultural fluency, and platform-specific execution, rather than brand awareness alone.

3. Technological Sovereignty and “New Quality Productive Forces”

Technology forms the backbone of China’s next growth cycle. The concept of “New Quality Productive Forces” reflects a shift from factor-driven growth toward innovation-led productivity gains.

This phase emphasizes systemic integration: software with hardware, data with manufacturing, and artificial intelligence with industrial processes.

China has made tangible progress in strategically sensitive areas:

- Improved domestic capabilities across semiconductor design, materials, and equipment

- Rapid development and commercialization of AI large models and industry AI systems

- Acceleration of advanced manufacturing, robotics, and autonomous systems

Beyond technology itself, China’s human capital base is a critical advantage. The country now ranks first globally in total R&D personnel and international patent applications, creating a powerful feedback loop between research, commercialization, and scale deployment.

For global technology firms, China in 2026 represents a parallel innovation ecosystem, where collaboration requires long-term alignment rather than transactional engagement.

4. Social Policy as Economic Infrastructure

China’s leadership increasingly recognizes that social stability functions as economic infrastructure. Demographic pressure, labor transformation, and rising expectations have driven a more targeted, confidence-oriented policy approach.

Recent measures reflect this shift:

- Introduction of a 300-yuan monthly childcare subsidy to ease family cost pressures

- Enhanced protections for gig-economy and platform-based workers

- Continued investment in elderly care, healthcare access, and community services

These initiatives are not merely social policies. They directly influence consumer confidence, spending behavior, and long-term economic resilience.

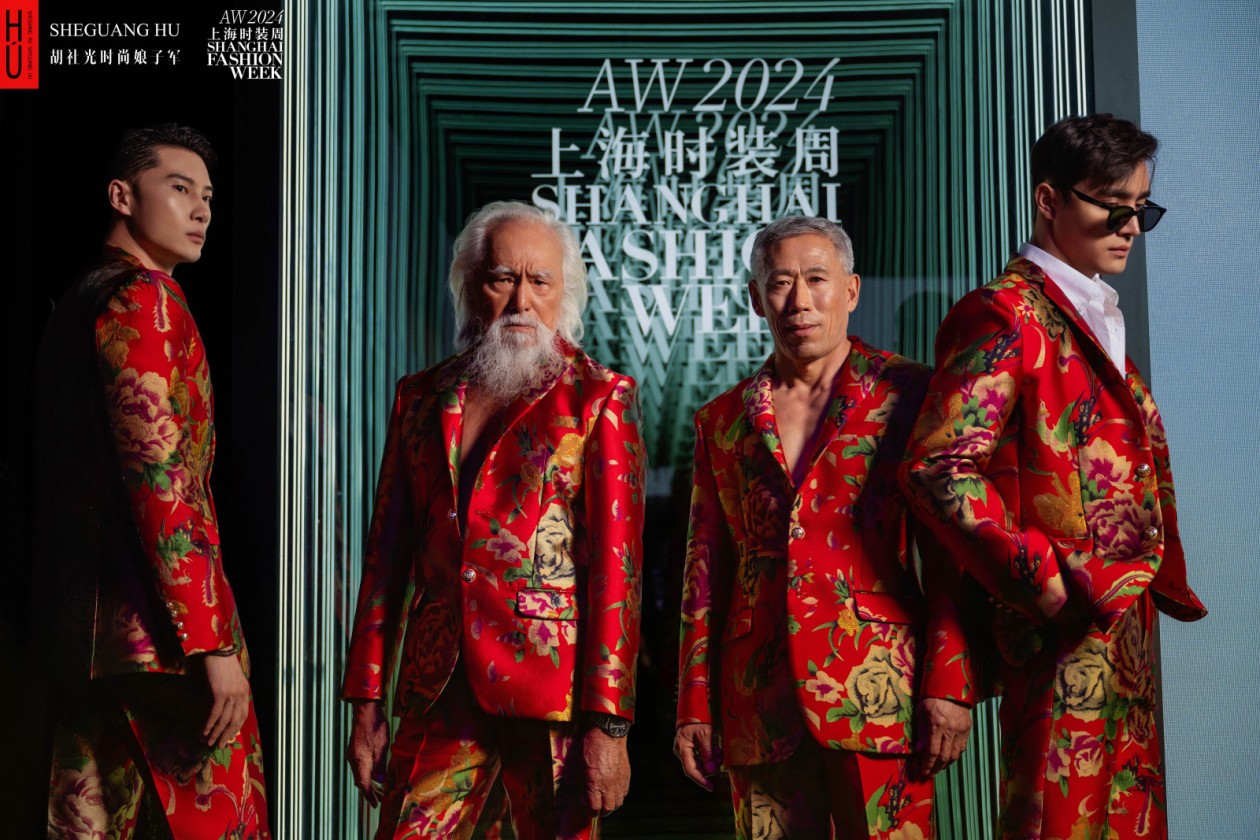

5. Cultural Renaissance and the Digital IP Economy

Culture has emerged as one of China’s most dynamic economic growth engines. Digitally rooted cultural IP, including games, film, and immersive experiences, is increasingly competitive on a global scale.

Trends such as the international success of Chinese digital IP and the domestic rise of experiential cultural consumption demonstrate a renewed confidence in localized storytelling.

This cultural renaissance is:

- Digitally amplified

- Commercially scalable

- Increasingly exportable

For brands, culture is no longer a peripheral consideration in China. It is a core strategic layer shaping relevance, trust, and long-term value.

6. China’s Global Strategy in an Era of Economic Fragmentation

At the global level, China’s 2026 positioning is shaped by a central concern: economic fragmentation.

Chinese leadership has warned that unchecked fragmentation could reduce global GDP by up to 7%, with disproportionate impact on emerging and mid-sized economies.

China’s response emphasizes:

- Support for multilateral trade and supply chain stability

- A pragmatic, risk-managed approach to major-power relations

- Long-term leadership in green development and energy transition

China has already built the world’s largest renewable energy system and remains committed to reaching carbon peak by 2030 and carbon neutrality by 2060.

These commitments anchor long-term investment opportunities in green technology, ESG infrastructure, and climate-linked finance.

7. Strategic Implications for Global Enterprises

China’s 2026 economic landscape requires a fundamental shift in strategic mindset. The country is no longer defined by low costs or speed alone.

Instead, China is evolving into:

- A high-standard digital laboratory

- A policy-oriented innovation ecosystem

- A deeply segmented, premium consumer market

The most sustainable opportunities lie in AI governance and enterprise deployment, green technology partnerships, and high-end consumer services.

China 2026 and the Next Growth Paradigm

China’s economic story in 2026 is not primarily about cyclical recovery or decoupling. It is about a systemic redefinition of growth. By embedding domestic demand into consumption-led development, integrating technology into productivity, aligning social policy with confidence, and reinforcing its role in global systems, China is shaping a new economic playbook for the next decade.

For international enterprises, this shift changes the basis of success. The most resilient strategies will be built on long-term alignment, deep localization, and disciplined risk management - not short-term arbitrage.

- Long-term strategic alignment: Winning in China increasingly means aligning with national priorities such as high-quality development, dual circulation, technological capability building, and green transition. Companies should treat China strategy as a multi-year commitment rather than a quarterly play.

- Deep integration and co-development: China is evolving into a real-world laboratory for frontier technologies, advanced manufacturing, and digitally enabled services. Participating effectively often requires local R&D, product adaptation, and ecosystem partnerships that accelerate learning and execution speed.

- Risk management through engagement: Geopolitical uncertainty, regulatory evolution, and intensified competition demand a balanced approach. Active stakeholder engagement, policy monitoring, compliant operations, and scenario planning can reduce volatility while keeping growth options open.

- Cultural fluency and brand storytelling: As the consumer market upgrades toward premiumization and experience-driven value, cultural relevance becomes a competitive moat. Brands that translate their value into locally meaningful narratives - across content, community, and commerce - will build longer-lasting trust.

- Commitment to sustainability: China’s renewable energy scale and long-term climate commitments continue to anchor opportunity in green tech, energy transition, climate-linked infrastructure, and ESG finance. Sustainability is increasingly a growth strategy, not a side initiative.

Ultimately, the core question for global companies and investors is no longer whether China matters, but how to participate in ways that are forward-looking, mutually beneficial, and resilient. Those who approach China as an evolving system - technologically, culturally, and environmentally - will be best positioned to capture enduring value in the 15th Five-Year Plan era and beyond.