Beijing, February 13, 2020. According to the latest IDC Worldwide Smart Cities Investment Guide (2019H1), IDC predicts that by 2020, the market-related expenditure scale of the global smart city will reach 124 billion US dollar, an increase of 18.9% compared to 2019. The top 100 cities by investment amounted to approximately 29% of the total cost of smart cities. Although in the short term, investment will be concentrated on large cities which developed earlier, the overall market will also show a trend of diversification, and the investment on small and medium-sized cities and small projects will increase.

By 2020, China’s smart city investment will reach $26.6 billion, making it the second largest spending country after the United States. The three focused investment areas are sustainable infrastructure, data-driven governance and digitalised management. Based on the forecast between 2018-2023, the total expenditure of this three focused areas will continue to exceed half of the overall smart city investment.

Serena Da Rold, Project Manager, IDC's Global Customer Insights and Analysis Departent, said: "In the latest Global Smart City Spending Guide, IDC has expanded its research and scale forecast for smart ecosystems, including the addition of smart ports, smart stadiums and smart campuses. At the same time, the number of cities in this period increased to more than 200. But there are less than 80 cities that annual expenditures of more than 100 million US dollars, and about 70% of investment was generated in the smart cities with annual expenditures of less than 1 million US dollars. This are the opportunities for those technology vendors in related sectors. They could apply those experience of large-scale projects to the smaller, diverse, and customer-friendly projects, creating value for small and medium-sized cities. "

Application Scenarios

The construction and development of smart cities provide a large numbers of application scenarios for emerging technologies, which has brought great development space for technology vendors. By 2020, the top three application scenarios for the Chinese market ’s expenditures are Smart Grids, Fixed Video Camera, and Connected Back Office. The investment scale of these three application scenarios account for more than 40% of total expenditure. The proportion of these three mainstream application scenarios will decrease as the market grow and mature. With the development of smart cities related technologies, the usage scenarios show a trend of diversification, and the influence of the fast-growing new scenarios will expand gradually. During the next 5-years forecast period (2018-2023), the Digital Twin, Vehicle to Everything Connectivity, and Open Data will become the fastest-growing application scenarios in China.

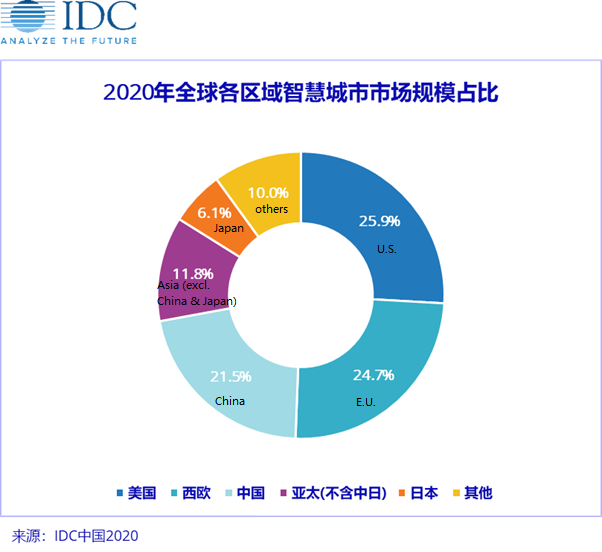

Looking at the city data of various regions around the world, Singapore will continue to maintain its leading position in smart city investment in 2020, while Tokyo surpasses New York to become the second largest city for investment. Due to the upcoming of the Summer Olympics Games, Tokyo strengthened its ICT investment in the later stages of infrastructure, public transportation, and stadium construction. The third and fourth most expensive cities are New York and London. In 2020, all these four cities' investments on building smart city will exceed $1 billion. From a regional perspective, the total market size of the United States, Western Europe, and China will continue to account for more than 70% of the global market in 2020, and the Latin America and Japan will be the fastest growing regions around the world.