Probably from the 1980s, Nike, Adidas and other basketball brands poured into the Chinese market, and the younger generation in China began to accept the baptism of sneaker culture.

The significance of sneakers to young people is not only the level of wearing, but also the label of pursuing fashion trends. However, with the changes in the market environment, the significance of sneakers has changed again, becoming the target of national investment.

The whole nation swarmed into the sneaker field, and the sneaker market turned ‘white-hot’.

The post-80s speculate in real estate, the post-90s speculate in Bitcoins, the post-00s speculate in shoes ... in the eyes of the post-00s, Bitcoin speculation is the past, shoes speculation is the current trend, and the word ‘shoes speculation’ is even included in Baidu Encyclopedia.How much money does it make to sell shoes, so that gold-buying Dama start to be crazy about shoes? The famous American rapper Kanye made a big profit of 1 billion US dollars last year with his Yeezy empire. Allen Kuo, a 20-year-old Chinese, earns millions by shoes speculation. Even the meat cut in the coin circle a few years ago can now be earned by selling a pair of shoes.

Brands who are well versed in consumers' mind are constantly stimulating the prosperity of the market by means of quotas, drawing lots, and so on, which have also plunged them into a crazy situation.

Integrating Financial Knowledge, Shoes Became ‘Futures’

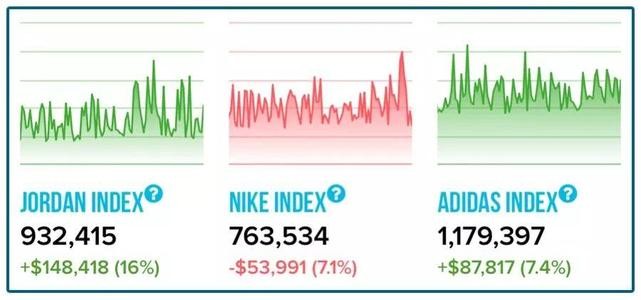

The outbreak of sneaker culture probably started in 1985. Nike first released the AIR JORDAN series of sneakers named after Michael Jordan, which aroused people's attention and pursuit of AJ sneakers and created a group of people who love and collect them. At this time, in order to create scarcity, major sneaker brands endowed sneakers with collection value and plated with a layer of golden light, sneaker products began to be limited in supply, thus creating a huge secondary market for sneakers.According to QuestMobile's ‘Sports Fashion Consumer Insight Report’ released in July this year, the number of monthly live users of typical sneaker app is above 3 million, and the number of monthly live users of Du APP has exceeded 8 million. In order to enable users or investors to better understand the market situation and grasp the latest information, some trading platforms add real-time up-and-down data and latest trading information of all kinds of sneakers on the page in a very ‘timely’ manner, draw K-lines for users to predict the price trend of sneakers, and even derive three indexes of ‘shoe speculation’: AJ index, Nike index and Adidas index. The form is close to the traditional exchange, and the shoe trading platform becomes the ‘shoe exchange’.

Bitcoin Circle Intruded into Sneaker Circle, Shoe Market ‘Capitalizes’

However, in the current wave of speculation in shoes, 55com.io has become the first shoes exchange in the world. it has introduced block chain technology into the fashion circle to realize the cross-border integration of coin circle and fashion circle, and has launched the fashion card pass, and the first ATO fashion card pass SUP was launched as early as May 21.

At present, the Fashion Pass AJOW (short for Air Jordan 1 Off-White Chicago) has been successfully issued for three rounds on August 1, 8 and 15. All the pass-through items are Air Jordan 1 Off-White Chicago sneakers, with a total circulation of 190,000 AJOW, corresponding to 100 pairs of sneakers' real assets. AJOW, the Fashion Pass issued on August 1, has an issue price of 0.1USDT, the highest in history to 2.2USDT, up 21 times from the issue price. While people are still amazed that shoes can also become investment targets, the ‘asset securitization’ in the sneaker market has become more and more formal.

Can sneakers that originate from SNEAKER culture and are inspired by fashion culture be destroyed by capital games? After the verification of numerous capital markets, it is only a matter of time before the capital game bubble bursts. When the game is over, who can be the real winner until the end?

Author: 安树(An Shu)

Quoted from iResearch